ila Credit Cards

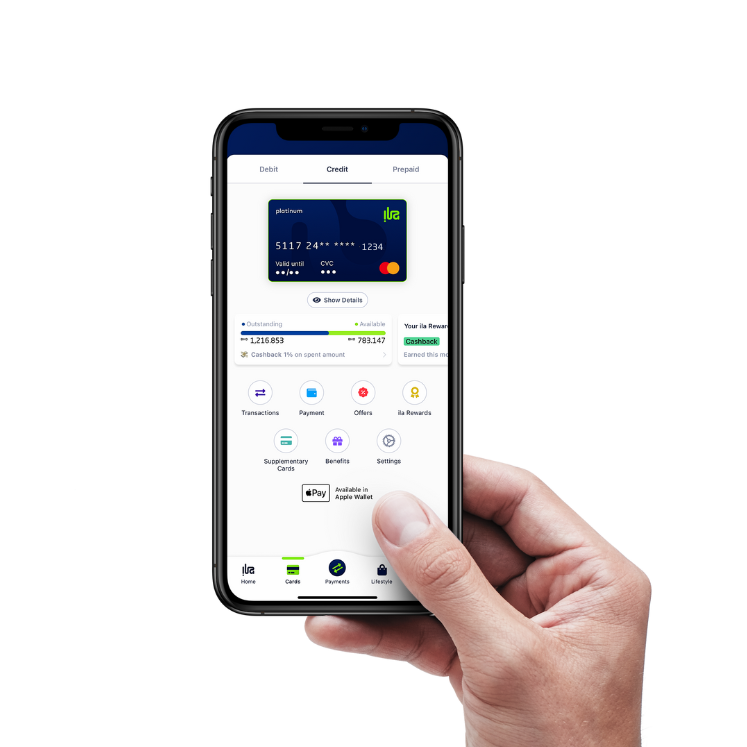

Seamless Convenience

Once you get your Credit Card, you’ll have 100% control at your fingertips.

• Set and change your PIN at anytime

• Access and filter your transactions easily

• Pay your Credit Card balance from the app

• Control your monthly payment

• View your ila rewards progress

• Freeze and unfreeze your Credit Card

• Apply for a Supplementary Credit Card for your direct family members

• Set controls on our Credit Cards' transactions and spends

ila Rewards Program

ila Rewards is a flexible reward program that allows you to choose how you want to be rewarded. With ila Rewards, you can switch between reward options every month easily and all in one app.

What are the Rewards options?

ila Credit Cardholders can enjoy the flexibility of choosing the Rewards they would like to receive:

Airline Miles - choose to automatically receive your Rewards as Airline Miles with Gulf Air or Turkish Airlines monthly.

Cashback - choose to automatically receive your Rewards as Cashback credited into your Credit Card monthly.

ila Tokens - Or choose to collect ila Tokens and spend it however and whenever you like. ila Tokens can be redeemed as Airline miles, Cashback or use your ila Tokens to pay for any existing transactions within the past 30 days!

Easily switch your Rewards options under the Credit Card tab.

How do I collect Rewards?

| Domestic Transactions | International Transactions | Government Transactions | Educational Transactions | Fuel, Charity, and Cash Withdrawal |

|---|---|---|---|---|---|

Airline Miles | 1 Airline Mile For every BHD 1 | 1 Airline Mile For every BHD 1 | 1 Airline Mile For every BHD 2 | 1 Airline Mile For every BHD 5 | NIL |

Cashback | 1% | 1% | 0.5% | 0.20% | NIL |

ila Tokens | 1 ila Token for every BHD 1 | 1 ila Token for every BHD 1 | 1 ila Token for every BHD 2 | 1 ila Token for every BHD 5 | NIL |

| |||||

Easy Payment Plans (EPP)

The EPP feature allows our Credit Card customers to break down their Credit Card transactions into convenient monthly installments at 0% interest up to 12 months, all through the ila Bank app.

What are the main features of EPP?

Interest-Free

ila Credit Cardholders can enjoy the benefit of 0% interest charges throughout the entire installment plan, offer is valid for a limited period!

On purchases with selected partners

You can choose to convert any Credit Card transaction worth BHD 500 and above made at jewelry shops, educational services, and selected airlines and partners.

Up to 12 months

ila Credit Cardholders can choose to break down their transaction into 3, 6, 9, or up to 12 months installments, all through the ila Bank app.

Transactions that are from ineligible merchants do not qualify for EPP, click here for more details.

Platinum Mastercard Benefits

Enjoy Mastercard Benefits with ila's Credit Cards, unlocking a world of travel, and lifestyle including:

• Enjoy 8% off on your travel booking with Clear trip, using promo code: MCPLATINUM. T&Cs apply.

• Free access to 25 airport lounges, click here

• Free membership and up to 30% off from MyUs.com

• 10% off on car rentals at Rentalcars.com

• European Shopping Village offers including Bicester Village

Visit www.priceless.com/benefits-mea to learn more about your Platinum Mastercard benefits and the redemption process.

Exclusive Partners Offers

Save with over 100 Partners in Bahrain, ranging from discounts when dining, shopping, restaurants, outlets and hotels.

• 20% off at the Royal Golf Club

• Up to 11% discount at all iMachines stores

• 10% off the bill at illy caffé

• Free size upgrade at Costa Coffee

• 10% off on your bill at all Gulf Hotel restaurants

• 10% off on valet parking at The Terminal, Adliya

For more offers

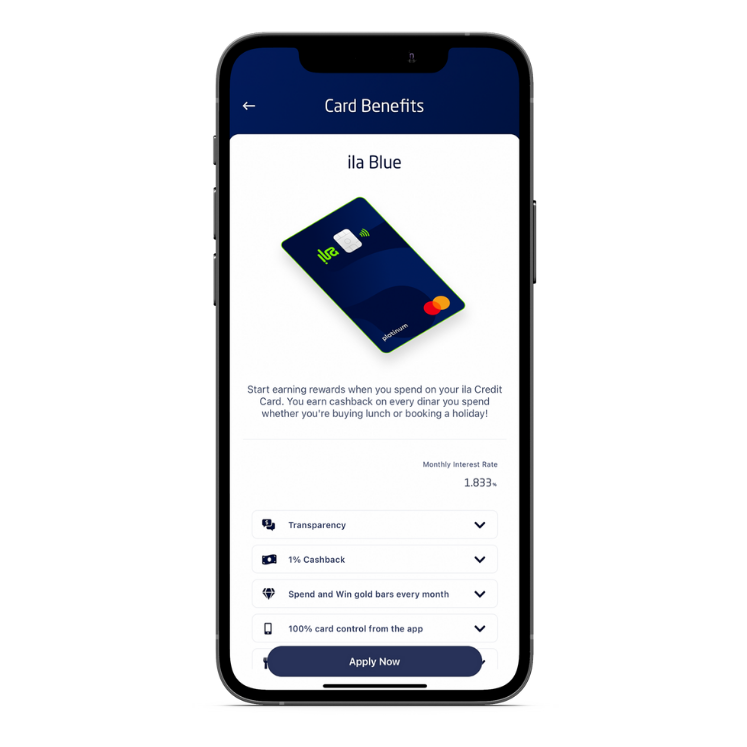

Credit Cards Comparison

| ila Blue | ila Switch |

|---|---|---|

Balance Transfer | - | ✓ |

Monthly Interest Rate | 1.833% | - Get 0% for 6 months on the Balance Transfer amount. After the 6 months are over, a 1.25% monthly Interest will apply on the remaining Balance Transfer amount. |

Annual Fee | Free | Free |

Eligibility | Age: Primary Cardholder - 21 to 65 years old Minimum monthly salary: Bahraini (Employed) - BHD 300 Non Bahraini (Employed) - BHD 500 Self Employed & Professionals - BHD 1,000 Length of Service: Bahrainis - Minimum 3 months Non Bahraini - 6 months | Age: Primary Cardholder - 21 to 65 years old Minimum monthly salary: Bahraini (Employed) - BHD 300 Non Bahraini (Employed) - BHD 500 Self Employed & Professionals - BHD 1,000 Length of Service: Bahrainis - Minimum 3 months Non Bahraini - 6 months |

Supplementary Credit Cards | ✓ | ✓ |

Global Airport Lounge Access | Airport lounge access at 25 airports globally | Airport lounge access at 25 lounges globally |

MyUS.com Premium membership | ✓ | ✓ |

Discounts on Car rentals and chauffer rides with Careem | ✓ | ✓ |

European shopping village offers | ✓ | ✓ |

Contactless payments | ✓ | ✓ |

3D Secure | ✓ | ✓ |

ila Switch (Balance Transfer): The ila Switch Credit Card is designed for customers who want to transfer their existing Credit Card balance with other banks to ila.

| ||

Applying for a Credit Card with ila is easy!

Are you already an ila customer? If not, start by opening an ila account, it only takes a few minutes.

1. Head over to the cards section in the app and tap on Credit

2. Select the preferred credit card and click on "Apply now"

3. Fill in a short application and upload a few documents